Fascination About Estate Planning Attorney

Fascination About Estate Planning Attorney

Blog Article

Some Ideas on Estate Planning Attorney You Should Know

Table of ContentsEstate Planning Attorney for BeginnersThe 5-Second Trick For Estate Planning AttorneyLittle Known Facts About Estate Planning Attorney.Estate Planning Attorney for Dummies

"Have you exercised prior to the court my case will be assigned to?"Judges and areas will have their very own minor variation of rules and distinct methods of case. Estate Planning Attorney. Discovering a probate attorney that knows with a court's preferences can make the procedure a great deal smoother. "The length of time do you estimate my instance will take before the estate will be settled?"This set can commonly differ.

A percent based on the estate value? Whether or not to hire a probate attorney depends on a range of components. You want to consider just how comfy you are navigating probate, just how difficult your state laws are and how big or substantial the estate itself is.

Estate Planning Attorney Things To Know Before You Buy

Those circumstances can be stayed clear of when you're effectively secured. Fortunately, Count On & Will is here to aid with any type of and all of your estate planning demands.

Strategies for estates can develop. Changes in properties, health and wellness, divorce, and also moving out of state needs to all be represented when updating your estate strategy. A count on lawyer can assist to update your depend on terms as suitable. The lawyers will solve depend on problems, oversee distributions and secure your ambitions and goals even long after your fatality.

These trust funds are valuable for a person who is either young or monetarily reckless. : Establishing a QTIP (Certified Terminable Interest Home Trust) will certainly guarantee that revenue from the Depend on would be paid to your making it through spouse if you pass away first. The continuing to be funds would be held in the original Count on, and after the partner passes away, the cash mosts likely to your recipients.

The Basic Principles Of Estate Planning Attorney

Your possessions are overlooked to your grandchildren, which means they are absolved from inheritance tax that might have been activated if the inheritance mosted likely to your youngsters. Listed below are ways in which a depend on can make your estate preparing a substantial success.: Probate is often too time-consuming and typically takes a year or more to complete.

Attorney fees and court costs can account for as much as 5 % of the value of an estate. Trusts can help you to settle your estate rapidly and efficiently. Assets in a count on are invested under the principles of Sensible Investment-these can enable them to grow enormously now and after your death.

The probate process is public. Thus, once your estate is provided for probate, your will, business, and monetary information become public record, revealing your enjoyed ones to haters, scammers, thieves, and malicious district attorneys. The exclusive and private nature of a count on is the opposite.: A trust protects your possessions from suits, creditors, separation, and read what he said other insurmountable challenges.

The Buzz on Estate Planning Attorney

In addition to protecting the rate of interests of a minor youngster, a trust can develop guidelines for circulation. Offer dependents even when you are dead: Youngsters and adults with special demands may take advantage of an unique needs depend on that attends to their medical and individual needs. Furthermore, it makes certain that you remain qualified for Medicare advantages.

An independent trustee can be designated if you believe your here are the findings recipients may not handle their properties carefully - Estate Planning Attorney. You can likewise set usage constraints. As an example, it can state in the Trust that possession distributions might just be made to beneficiaries for their welfare needs, such as buying a home or paying clinical bills and not for flashy automobiles.

Your estate plan need to consist of input from several individuals. Allow's look at the functions of individuals entailed in estate planning Once the important point residential property making plans data are developed- which are composed of a it's much crucial to specify the jobs and duties of the people called to serve in the ones documents.

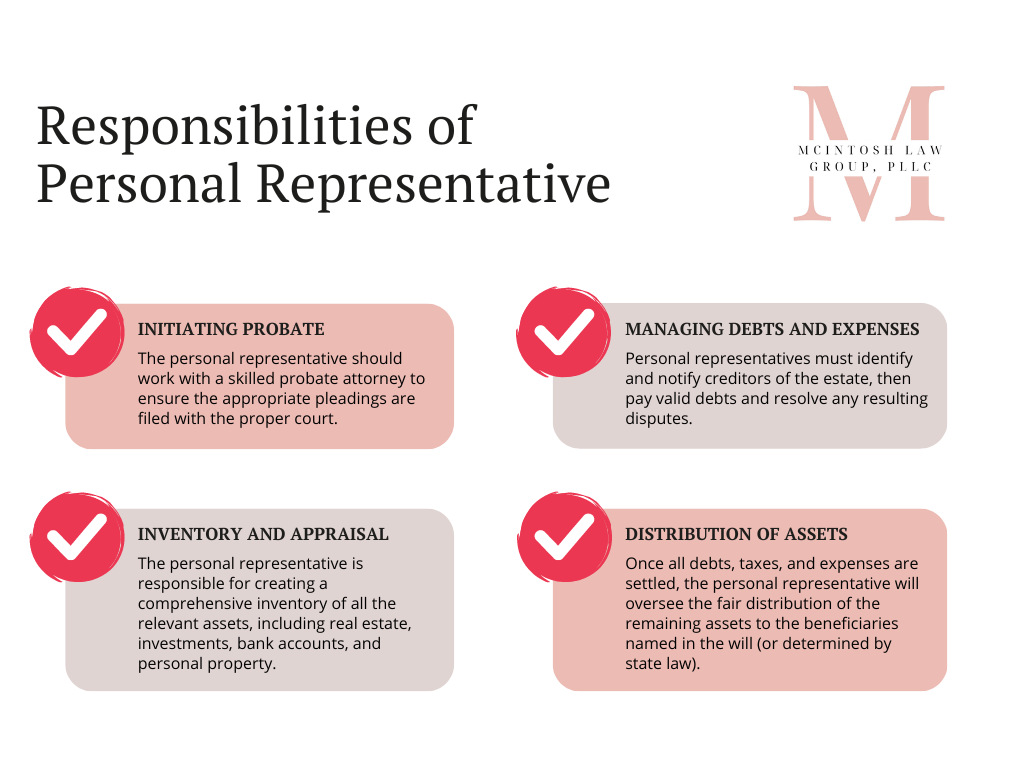

Carrying out a Will can be very taxing and calls for selecting somebody you trust to manage the duty's responsibility. The administrator will supervise the whole probate process. According to their standard procedure guidelines, the court will certainly designate a manager for your estate if you do not have a Will. If this must happen, your property and accounts will certainly be dispersed to whomever state legislation establishes ought to sites be the recipient.

Report this page